Precious Metals

Why Invest in Precious Metals?

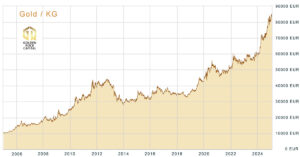

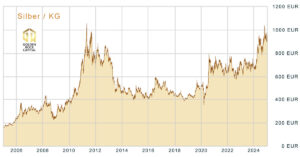

Gold and silver have long been regarded as safe havens in times of crisis. Those who purchased a quantity of precious metals around 50 years ago are still benefiting from a sound, value-retaining investment. By contrast, investments in bank accounts or supposedly secure government bonds over the same period often resulted in near-total losses.

Gold and its “younger sibling,” silver, have repeatedly proven to be effective inflation-protected investments. Given today’s turbulent economic climate and the outlook for the future, they are attracting increasing attention from investors.

Experts estimate that the peak of new gold and silver production was already reached at the start of this millennium. As scarcity is anticipated, both metals are transitioning from purely serving as inflation protection to becoming yield-generating assets.

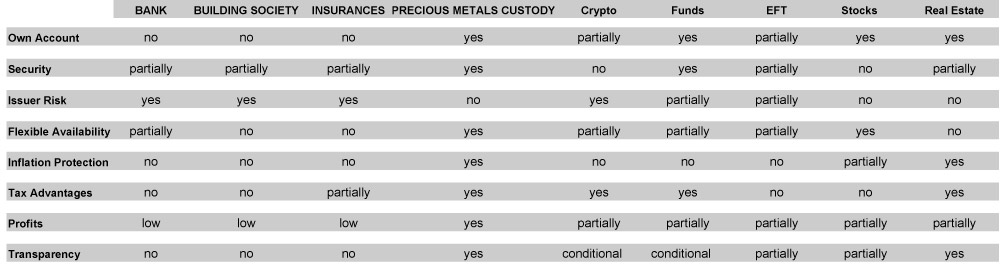

The overview below highlights which form of investment may suit you best, based on the eight key criteria of an optimal investment.

Only one investment meets all these criteria.

Gold

Preservation of Value: Gold is often considered a “safe haven,” having retained value throughout history, particularly during periods of economic uncertainty. In times of crisis, demand for gold typically rises, as it is seen as a stable and reliable asset.

Diversification: Gold can help diversify an investment portfolio. Its low correlation with other asset classes, such as stocks or bonds, can reduce overall risk and help offset potential losses.

Inflation Protection: Gold is frequently used as a hedge against inflation. When prices rise and purchasing power falls, the value of gold often increases. Investors use it to maintain the stability of their wealth.

The price of gold can fluctuate due to economic conditions, interest rates, currency movements, geopolitical events, and supply-demand factors. Historically, however, gold has demonstrated strong long-term performance, making it a trusted choice for preserving and growing wealth.

Industrial Uses of Gold:

Jewellery: Gold has long been prized in jewellery making for its beauty, rarity, and durability.

Electronics: Gold’s excellent conductivity makes it essential in electronic components, circuit boards, and connectors.

Medical Applications: Gold is used in dentistry for fillings, crowns, and implants due to its biocompatibility.

Industrial demand also influences the overall demand and price of gold. Nevertheless, investment decisions should take into account personal goals, risk tolerance, and market knowledge. Seeking professional financial advice is strongly recommended.

Silver

Industrial Demand: Silver has widespread industrial applications, including electronics, photography, solar energy, medicine, the automotive industry, and more. Rising industrial demand, combined with limited supply, can drive price increases.

Silver prices are influenced by a range of factors, including supply and demand, industrial usage, economic conditions, inflation, currency movements, and geopolitical events. Historically, silver has shown both periods of significant volatility and strong long-term value growth.

Industrial demand remains one of the most important drivers of the silver market. Silver is used extensively in electronic devices, solar panels, batteries, mirrors, catalysts, and a wide variety of other applications.

Platinum

Rarity and Scarcity: Platinum is one of the rarest precious metals, challenging to mine and available only in limited quantities. Its scarcity, combined with sustained demand, can support long-term value growth.

Industrial Use: Platinum is widely used in the automotive industry for catalytic converters that reduce emissions. It is also utilised in jewellery, electronics, chemical processing, and medical technology. Industrial demand—particularly from the automotive sector—plays a major role in influencing its price and overall value development.

Preservation of Value: Historically, platinum has retained its value and is regarded as a “noble metal,” offering protection against inflation and currency fluctuations.

Platinum prices are shaped by supply-and-demand dynamics, industrial usage, economic conditions, geopolitical events, and investor sentiment. While its price has shown fluctuations over time, platinum has also demonstrated notable long-term appreciation.

Palladium

Palladium prices are shaped by supply-and-demand dynamics, industrial usage, economic conditions, geopolitical events, and investor sentiment. Industrial demand is the primary driver, with key applications in electronics, medical technology, chemical processes, and jewellery. Palladium is used in electronic components, dental alloys, industrial catalysts, and various portable devices.

Primary Use: Palladium is predominantly used in the automotive industry for catalytic converters in petrol engines, helping to reduce harmful emissions and support environmental protection.

Scarcity and Limited Supply: Palladium is an exceptionally rare precious metal and among the rarest elements in the Earth’s crust. Extraction is technically challenging and costly. Its limited supply, combined with robust industrial demand, can support potential long-term value growth.

Preservation of Value: Palladium has maintained its value over time and is highly regarded due to its industrial applications and scarcity. It can serve as a hedge against inflation and periods of economic uncertainty.

or send us an email: service@golden-rock.eu