Finanzplan

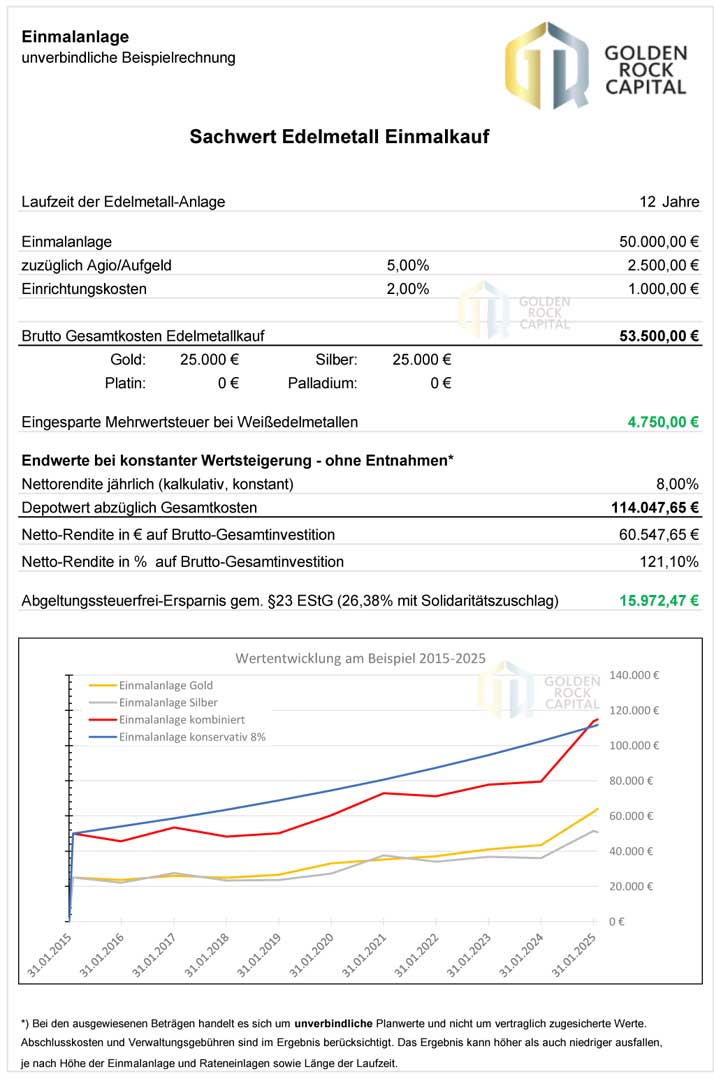

The calculation is based on a one-time average investment in precious metals by our clients, over a non-binding term of up to 12 years. The investment period may be extended to 35 years at no additional cost.

Key Points Explained:

- One-Time Investment and Costs:

The total investment amounts to €53,500, including premium and setup fees. These are based on standard business offers for private clients. - VAT Savings:

Investing in white precious metals includes a VAT saving of €4,750. - Returns and Final Value:

Assuming a constant net return of 8% per annum, the expected portfolio value at the end of 12 years is €114,047.65, resulting in a profit of €60,547.65. This corresponds to approximately 121.10% of the total gross investment. - Tax Advantages:

Precious metals are tax-free under §23 EStG, resulting in a tax saving of €15,972.47 (26.38% including the solidarity surcharge). - Additional Notes:

The figures shown are non-binding projections and may be higher or lower in practice. Acquisition costs and management fees are already included in these results. For monthly instalment payments, precious metals accumulate gradually over time. This means that with shorter investment periods, returns are generated only on the value of metals actually held in the portfolio, rather than the total planned investment.

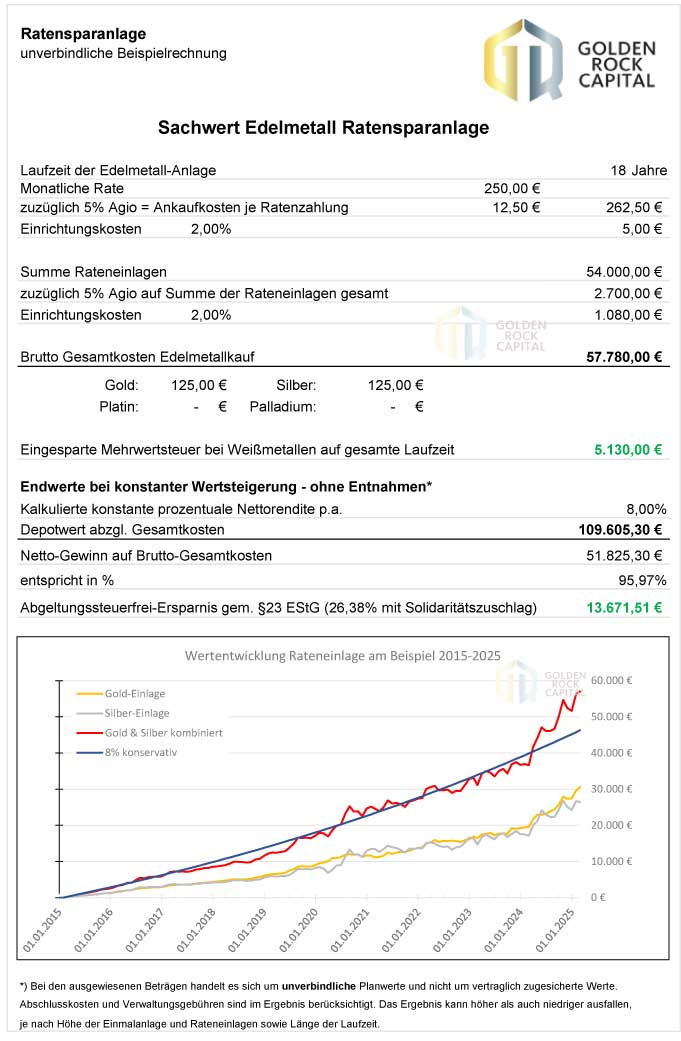

This example illustrates how a portfolio could develop over an 18-year period.

The calculation is based on a one-time average investment in precious metals by our clients, over a period of up to 18 years.

- Installment Investment and Costs:

The total investment amounts to €57,780, including premium and setup fees. These fees reflect standard offers for new clients. Consequently, the expected return in our attached calculation is higher, as we provide more favourable conditions than typical market standards for private clients. - VAT Savings:

Investing in white metals includes a VAT saving of €5,130. - Returns and Final Value:

Assuming a constant net return of 8% per annum, the expected portfolio value at the end of 18 years is €109,605.30, resulting in a profit of €51,825.30. This corresponds to approximately 95.97% of the total gross investment. - Tax Advantages::

Precious metals are tax-free under current tax law, resulting in a tax saving of €13,671.51. - Additional Notes:

The figures shown are non-binding projections and may vary. Acquisition costs and management fees are already included. For monthly instalments, precious metals accumulate gradually over time. Shorter investment periods will generate returns only on the actual metals held in the portfolio, rather than on the total planned investment.

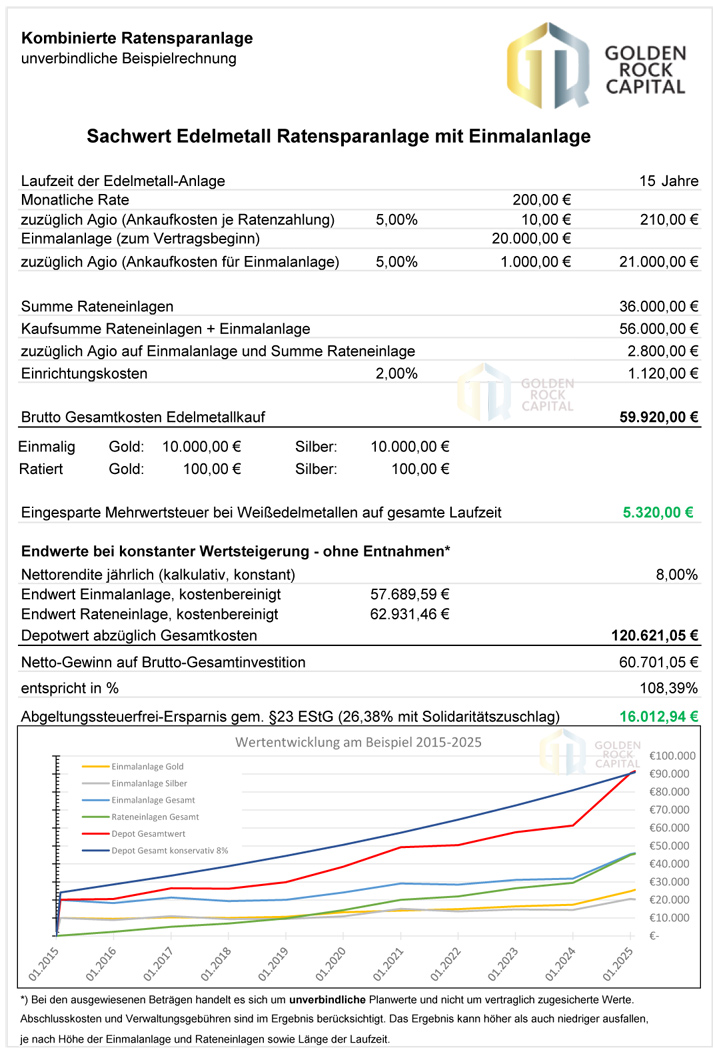

This example illustrates how a portfolio could develop over a 15-year period.

The calculation is based on a one-time average investment in precious metals over 15 years.

Total Investment Costs:

- VAT Savings:

Investing in white precious metals includes a VAT saving of €5,320. - Returns and Final Value:

Assuming a constant net return of 8% per annum, the expected portfolio value after 15 years is €120,887.05, resulting in a profit of €62,927.05. This corresponds to approximately 112.37% of the total investment. - Tax Advantages:

Precious metals are tax-free under §23 EStG (26.38% including the solidarity surcharge), resulting in a tax saving of €16,600.16. - Additional Notes:

The figures provided are non-binding projections and may vary. Acquisition costs and management fees are already included. For monthly instalment payments, precious metals accumulate gradually over time. Shorter investment periods will generate returns only on the metals actually held in the portfolio, rather than on the total planned investment.

Golden Rock Capital’s Continuous Security Services

- Your precious metal holdings are strictly segregated from the assets of the companies managing them, providing full protection against insolvency risks.

- All precious metals are delivered exclusively by certified, reputable refineries that meet the London Good Delivery Standard.

- Access to the high-security vault is safeguarded by a six-eyes principle, requiring the presence of:

A representative of the vault operator

A representative of a Swiss security company

A representative of the precious metals supplierr - The Swiss security company ensures secure storage and is responsible for periodic reporting of the stored precious metals to an independent auditor.

- The auditor verifies the holdings and confirms the actual value of all stored precious metals, providing an additional layer of transparency and security.

or send us an email: service@golden-rock.eu